If you can’t measure it, you can’t manage it.

For employers, that applies to the effectiveness of their healthcare benefits. According to the results of the 2019 Health Benefits Cost Containment Report, most employers are not measuring the return on investment of many of the most commonly offered health benefits.

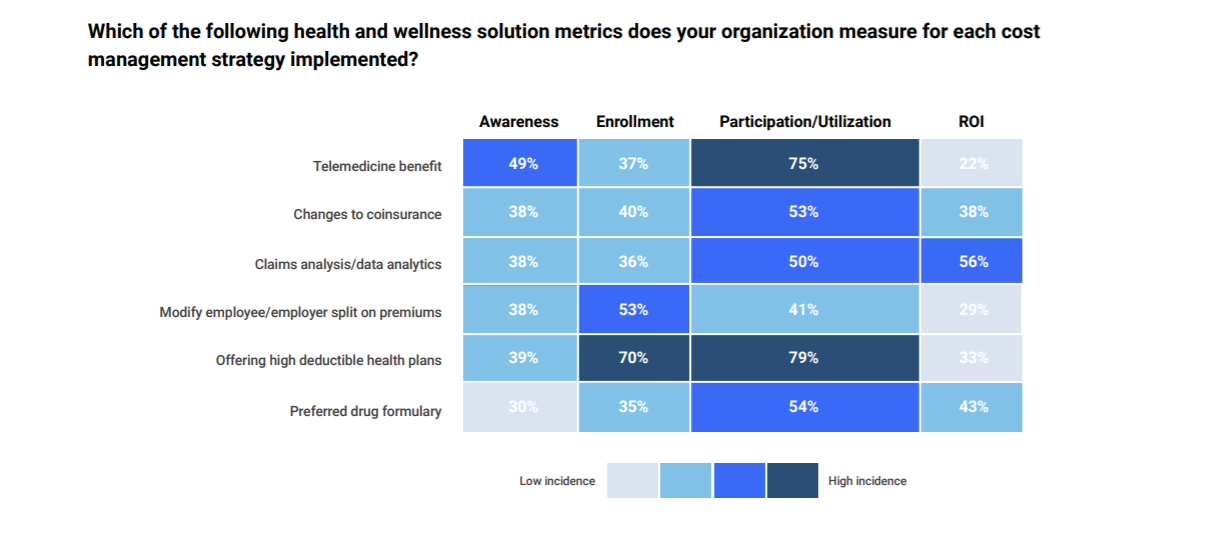

The 2019 report found that just over half of employers measured the ROI of claims analysis/data analytics, and most did not measure the ROI of offering telemedicine, modifying the employer/employee split on premiums or offering high-deductible health plans.

As measuring ROI is vital, the fact that so many don’t is concerning. Employers are quite literally banking on their benefits providing value. They need both soft returns — healthier, more productive employees, and hard returns — in the form of dollars saved.

But if ROI isn’t measured, how can employers understand whether they’re realizing any value? Spoiler: they can’t.

Health Benefits Costs Rising for Employers

Average annual health premiums are rising. And while employees have been hit hard, employers have largely borne the brunt of increases.

In 2009, employers contributed an average of $9,860 per employee for family coverage, on a total premium of $13,375. In 2019, employers are contributing an average of $14,561 annually for the same coverage, on a total premium of $20,576, according to the Kaiser Family Foundation.

More than ever, employers need healthcare benefits that, at the very least, won’t continue to raise costs and, ideally, will lower them by providing a positive, hard-dollar ROI.

ROI Is Tough to Measure

It’s no surprise that claims analysis is the benefit most measured, as the data is readily available. As for other benefits, HR often doesn’t have the data — or adequate staff to gather it — to measure ROI.

For some wellness benefits, it can be nearly impossible to assess the results of a given benefit — and sometimes the results don’t manifest for several years.

Take, for example, a smoking-cessation program. How can an employer know for certain that a reduction in claims associated with smoking-related illnesses has resulted from their wellness program? Claims may be lower because some employees kicked the habit because smoking products cost more, or because they fear developing vaping-related illnesses. Or maybe a few smokers retired.

The program may have helped, but it’s hard to say with certainty.

What Can Employers Do?

Employers must make ROI a top priority. Those who struggle to measure their returns have no idea whether their benefits are effective and efficient, so they can’t begin to reduce healthcare costs through cost-containment methods.

We know that HR is stretched thin. That’s why employers should work with healthcare benefits vendors that also understand the necessity of measuring ROI. Strong vendors have the hard data enabling them to calculate and report ROI to their clients. With ROI measured and reported, employers can then get on with managing their costs.

.png?width=1080&height=1080&name=Resource%20Center%20Designs%20-%20Website%20Updates%20(1).png)

Check out our Resource Center

Learn more about our Primary Care, Urgent Care, and Mental Health Care

Learn more

Table of contents